After entering the tide of foreign trade orders, the container shipping market exploded on almost all routes in October. Judging from the market disclosure information, the price increase tide in November is coming, and many shipping companies have announced price increases. Let's take a look at which companies have raised prices, which routes have the most ruthless price increases, and what time node will there be room for price reduction in the future.

Recently, Hapag-Lloyd, Maersk, CMA CGM, Wanhai Shipping, etc. have successively issued price increase notices. There may be three major factors in this.

First, the explosion of the cabin. According to relevant industry insiders, in October, there has been a burst of cabins on the opening flights, especially at the end of October, the explosion of cabins involves almost all directions of routes, of which the explosion of cabins in the direction of the United States line will be postponed to November. The main reasons are that shippers rushed to concentrate on shipping before the price increase of liner companies, predicted the impact of the US election results, and changed the shipping patterns of Chinese shippers.

Secondly, reduce shifts. According to Huafu Securities, the reduction of foreign trade container transportation has led to price increases. According to its research report, the shipowner's empty flight plan supports the shipowner's increase in the short term. The first two weeks of November were significantly reduced due to the airline schedule, which also means a significant increase in loading rates for the same volume.

In addition, negotiations for a new long-term contract have begun. At the same time of explosion and reduction of shifts, November entered the long-term negotiations of many container shipping in 2025, especially the European route, which took the lead in entering the intensive negotiation stage between the two sides of the cargo in November. According to market news, some shipping companies plan to increase the freight rate per 40-foot container to 2500~3000 US dollars, an increase of 25%~36% compared with last year.

The highest wave of sea freight price increase is 5,700 US dollars, let's take a look at the shipping companies that have recently announced price increases, and what are the specific price increases?

1. Hapag-Lloyd: From Asia to the west coast of South America, Mexico, Central America and the Caribbean, the GRI will be raised from Asia to the west coast of South America, Mexico, Central America and the Caribbean from November 1, 2024. The increase applies to 20-foot and 40-foot dry containers (including high cubes) and 40-foot non-operating reefers, at $2,000 per container, and will be valid until further notice.

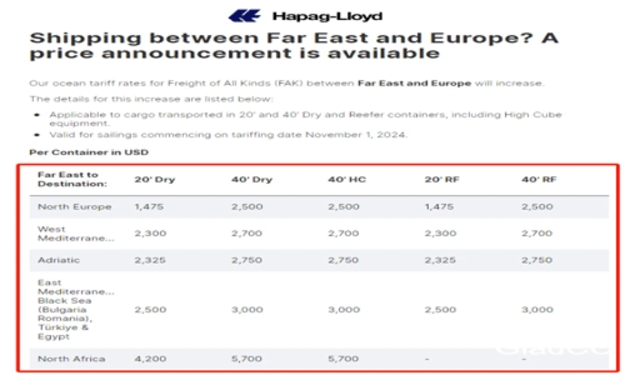

From the Far East to Europe, the FAK from the Far East to Europe will be raised from November 1, 2024. The rate change applies to 20-foot and 40-foot dry containers (including high cube and 40-foot non-operating reefers) and will be increased to a maximum of $5,700 until further notice.

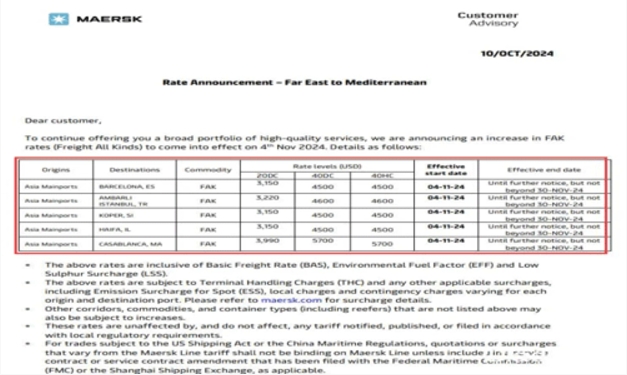

2. Maersk Far East to the Mediterranean announced on October 10 that it will increase the FAK rate for the Far East to the Mediterranean route from November 4, 2024, aiming to continue to provide customers with a wide portfolio of high-quality services. As you can see, it can go up to $5700.

3. CMA CGM Asian ports (including Japan, Southeast Asia and Bangladesh) to Europe announced on October 10 that from November 1, 2024, the new FAK rate from all Asian ports (including Japan, Southeast Asia and Bangladesh) to Europe will be adjusted, with a maximum of $4,400.

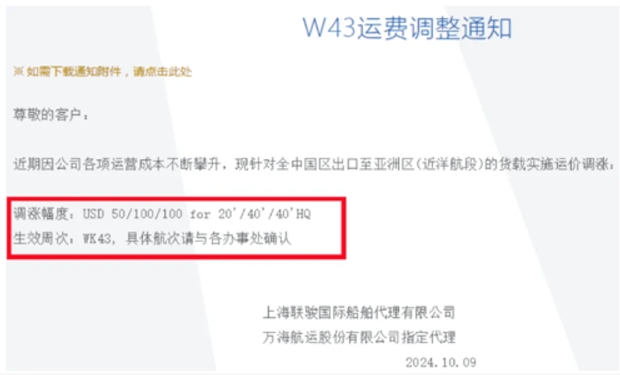

4. Wan Hai Shipping issued a freight adjustment notice for the whole China to Asia (near ocean section), pointing out that due to the rising operating costs of the company, it was decided to increase the freight rate for the cargo load exported from China to Asia (near ocean section). The specific increase is as follows: 20-foot container increased by 50 US dollars (USD 50), 40-foot container and 40-foot high cube container increased by 100 US dollars (USD 100). The change will take effect in the 43rd week. That is, at the beginning of November.

5. ZIM announced that it will update its peak season surcharge (PIS) from the Far East to the Eastern Mediterranean and the Western Mediterranean (including Black Sea and Northern European ports) in view of the current market conditions, effective November 1, 2024

6. Hanxin Shipping Asia to Europe and the Mediterranean Hanxin Shipping (HMM) announced that in order to maintain its reliable and high-quality service level, it will implement a new freight by weight or volume (FAK) rate from Asia to Europe and the Mediterranean region from November 1, 2024, which will continue until further notice.

Will the price hike continue until January next year? Professionals in the shipping field said that because ship resources are concentrated in the hands of several major shipping companies, it is difficult to directly dialogue with airlines with the size of most foreign trade enterprises, let alone price negotiations, which often need to be carried out through agents. And the sudden price increase and lack of space is undoubtedly a bad "first blow". As for how long will such a price increase trend go? Wu Jialu, head of the industrial and cyclical group of the CITIC Futures Research Institute, believes that the follow-up freight rate will show a strong trend of shock. The industry is also optimistic about the duration of this round of "shipment tide", believing that it may last until the end of this year or even January next year.

Is there a way to avoid the risk of shipping price fluctuations? The container shipping index futures mentioned at the Finance and Insurance Forum of the North Bund International Shipping Forum recently may be a big way out.

At the forum, He Jun, deputy general manager of the Shanghai Futures Exchange, introduced that in December last year, due to the impact of the Red Sea situation, sea freight rose sharply, and a company planned to ship 14 large containers to Europe in March this year, which should have been about 150,000 yuan higher than planned, but the company's final freight cost not only did not rise, but also lowered 80,000 yuan than normal. This is the credit of the container shipping index (European line) futures. Through hedging transactions, the futures side made a profit of 230,000 yuan, which was offset by the increase in freight costs, and the freight costs did not increase but decreased. It is reported that the container shipping index (European line) futures is China's first shipping futures variety listed on the basis of the freight index released by the Shanghai Aviation Exchange in August last year. It is reported that it not only allows market participants to grasp the fluctuations of the shipping market in a timely manner, but also provides a tool for entities to avoid the risk of freight rate fluctuations.

Specifically, to play its function, taking an international supply chain enterprise as an example, at the beginning of June this year, a foreign trade cargo owner enterprise found them and asked to provide cargo transportation services for Asia-Europe routes, with a shipment of 5 containers, and the shipping time was at the end of July, and the freight rate of each container was not higher than 6,500 US dollars. At that time, they judged that by the end of July, the container freight rate could rise to $8,000, which would result in a net loss of $1,500 per box. So how do you circumvent it?

The supply chain company bought a call contract for container shipping index (European line) futures at the beginning of June, and by the end of July, the price of containers really rose to $8,500, although the price rose by $2,000, but their company bought call futures in the futures market in advance, which greatly reduced the losses caused by the rise in container prices. It is reported that at present, in addition to the container index (European line) futures, the United States line has also been available, and in the future, it is revealed that futures trading can be extended to various routes.

The emergence of this container shipping index futures tool may help more and more foreign trade and supply chain enterprises reduce the risk caused by shipping price fluctuations.

resource: logistics salon

Related News

Contact Us

English

English  Español

Español  日本語

日本語  한국어

한국어  français

français  Deutsch

Deutsch  italiano

italiano  русский

русский  português

português  العربية

العربية  tiếng việt

tiếng việt